Digital User Analytics for Financial Services

ReplayBird empowers financial services brands to deliver better digital experiences with intuitive, automated, and comprehensive analytics.

Benefits

Save Time

Save Time Instantly capture and analyze behaviors as they happen in real-time.

Enhanced User Experience

Enhanced User Experience Gain comprehensive customer insights for a complete understanding.

Boost Revenue

Boost Revenue Identify emerging possibilities to drive revenue growth

Customer Satisfaction

Customer Satisfaction Remove barriers and delight customers with effortless interactions.

Pinpoint and Resolve Bugs

Pinpoint and Resolve Bugs Effectively address, troubleshoot, and resolve problems for prompt resolution.

Privacy-Driven Integration

Privacy-Driven Integration Prioritize privacy and secure integration for driving continuous innovation.

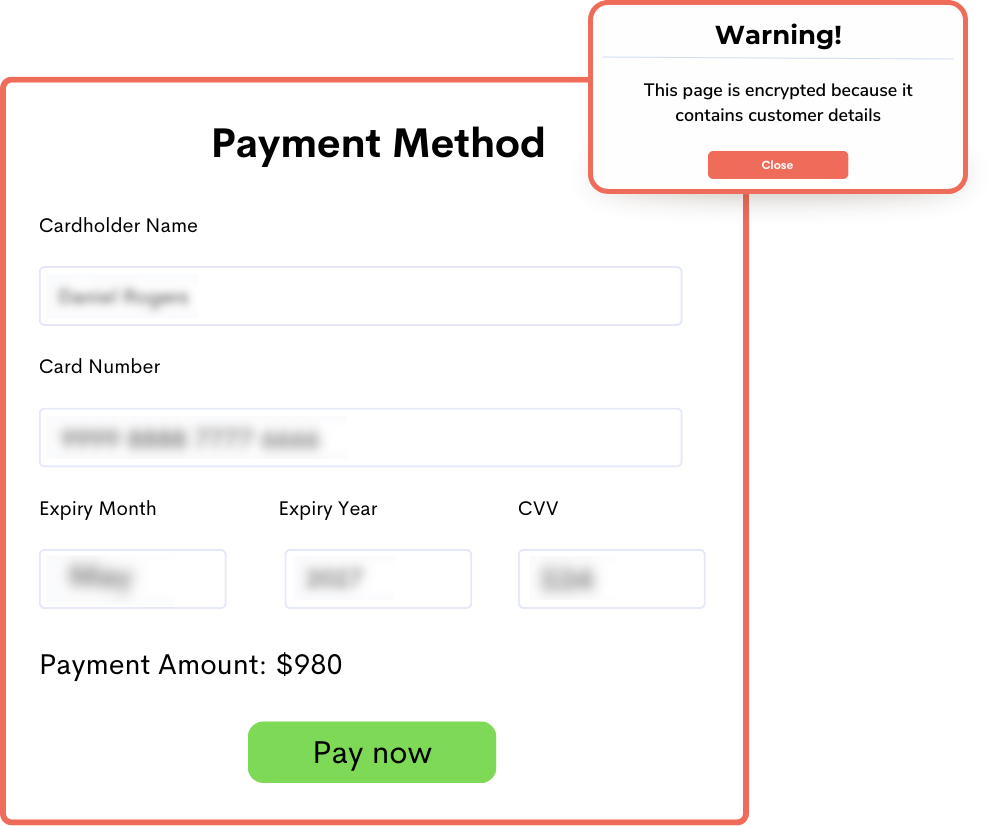

Don't make your website have a fraudulent impact on your website visitors

ReplayBird provides insights into the real-time needs of your customers in order to optimize your website content.

Get a complete picture of the user experience and behavior on your website

Every website visitor can be converted into insights with ReplayBird to give your visitors the best digital experience. Technical errors on your website make you lose more than you expected. Use ReplayBird to recover them.

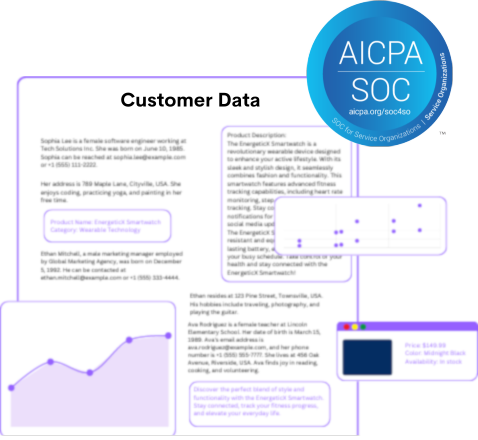

Protect your Valuable Customer Data

Identify potential risks and vulnerabilities within your organization's systems and processes and reduce the risk of data breaches, unauthorized access, or other security incidents.

Engage, convert, and retain your financial services customers

By providing businesses with actionable insights into their customer behavior, ReplayBird’s digital experience analytics platform helps finservs generate revenue and boost customer satisfaction. ReplayBird is the one solution for all three financial services customer satisfaction actions such as engaging, converting, and retaining.

Get your free trial now!Stop guessing what your visitors want.

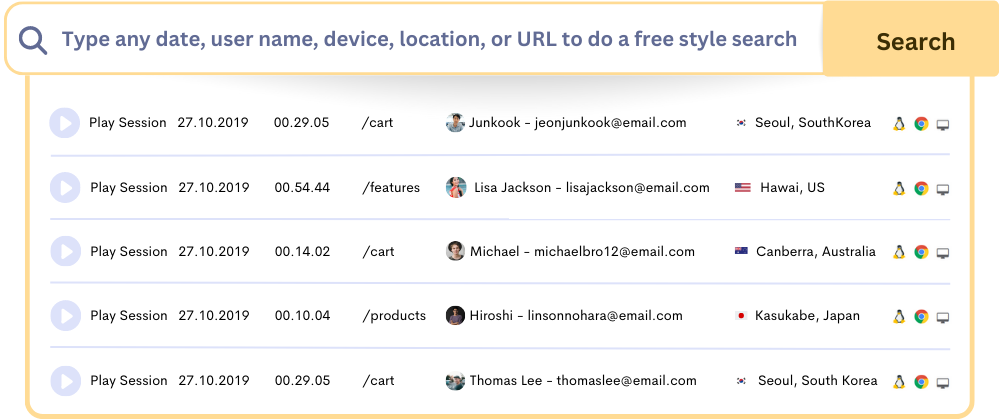

Playback everything visitors do on your site.

Watch visitor behavior

Watch visitor behavior Watch movements of your visitor’s using session recordings.

Notes, Segments and Tags

Notes, Segments and Tags Add notes, segments and tag to your recording for easy identification.

Easy Installation

Easy Installation Installation is quick and simple using a javascript tarcking code.

Performance monitoring

Performance monitoring Assess your site's user experience and uncover areas for improvement.

Unlimited team members

Unlimited team members Invite all your team members and clients at no added cost!

Block IPs

Block IPs Exclude tracking yourself, your team or clients by blocking their IPs.

Share

Share Share notes and website recordings to your fellow mates.

User Identify

User Identify Track users to identify which users are having bad user experience.

Audit Logs

Audit Logs See security audit logs for your projects and accounts.

Frequently Asked Questions

- Understanding user behavior: By replaying user sessions, businesses can see how users interact with the site, including their clicks, scrolling behavior, and mouse movements. This information can be used to identify areas where the user experience can be improved, such as by simplifying a confusing process or making information easier to find.

- Debugging issues: Session replay can also be used to help diagnose issues that are impacting the user experience. For example, if a user reports that they were unable to complete a transaction, the session recordings can be used to see exactly what went wrong and help diagnose the problem.

- Improving conversion rates: By improving the user experience, businesses can increase the likelihood of successful transactions and conversions. Session replay can help identify areas where the process can be optimized, such as by streamlining the checkout process or reducing friction in the purchase process.

- Personalizing experiences: By combining session recordings with other data, such as user demographics or purchase history, businesses can create more personalized experiences tailored to each user's needs.

- Understanding customer needs: By analyzing customer behavior and usage patterns, product analytics can help businesses understand the needs and preferences of their customers. This information can be used to inform the development of new financial products that meet customer needs and drive growth.

- Measuring product success: Product analytics can help businesses track key metrics such as adoption, usage, and customer satisfaction, providing valuable insights into the success of existing financial products. This information can make data-driven decisions about which products to focus on and which to phase out.

- Identifying areas for improvement: Product metrics can also identify areas where existing financial products can be improved. For example, if usage data shows that customers are having difficulty with a particular feature, the product roadmap can be updated to address these issues and improve the overall user experience.

- Assessing market trends: Product analytics can help businesses stay on top of market trends and identify new opportunities for growth. For example, if usage data shows that customers are increasingly interested in certain financial products, businesses can consider adding these products to their roadmap to stay ahead of the curve.

- Conversion rate

- Bounce rate

- Average session duration

- Funnel-web conversion rate

- Return on investment (ROI)

- Customer lifetime value (LTV)

- Acquisition sources

- Understanding customer behavior: By tracking key metrics such as conversion rate, bounce rate, and average session duration, businesses can understand how customers are interacting with their financial websites. This information can be used to identify areas for improvement, such as by streamlining processes or improving the user experience.

- Improving conversion rates: By identifying areas where customers are dropping off in the conversion process, businesses can make improvements to increase web conversion rates. For example, suppose a high number of customers are abandoning their carts. In that case, web analytics can help identify the cause of this issue and inform the development of solutions to reduce cart abandonment.

- Optimizing marketing campaigns: Web analytics can provide insights into website traffic sources, helping businesses understand which marketing campaigns are driving the most traffic and conversions. This information can be used to optimize marketing campaigns, targeting the channels that are delivering the best results.

- Enhancing the user experience: Web analytics can also be used to identify areas of the website that are causing friction for users, such as confusing navigation or slow load times. By improving these areas, businesses can enhance the overall user experience and increase the likelihood of successful transactions.

- Improving search engine optimization (SEO): Web analytics can also provide insights into which keywords and phrases customers are using to find the financial website, helping businesses optimize their content for search engines and improve their search engine ranking.

For example, if a customer is in the process of making a purchase, the business might offer a related product or service at a discounted price. This can help increase the average order value and drive additional revenue.

Funnel analytics can also help businesses understand which products or services are most likely to be upsold or cross-sold, allowing them to tailor their offerings to specific customer segments.

By analyzing the funnel, businesses can identify patterns in customer behavior and use this information to inform their cross-selling and upselling strategies.

Financial industries must also ensure that they are complying with data privacy regulations, such as the General Data Protection Regulation (GDPR) in the European Union, to ensure the accuracy and security of their data.

Here are some steps that financial industries can take to ensure the accuracy of their funnel analytics data:

- Proper tracking implementation

- Data quality checks

- Data validation

- Data segmentation

- Data normalization

- Regular audits.

- Improved customer experience: By identifying and resolving errors quickly, error tracking helps improve the customer experience and increase customer satisfaction.

- Increased efficiency: Error tracking can save time and increase efficiency by automating the error detection and resolution process. This allows businesses to focus on more strategic initiatives rather than spending time fixing errors.

- Enhanced security: Error tracking can help identify and prevent security breaches by alerting businesses to potential vulnerabilities in their software or website.

- Improved software quality: Error tracking can help improve financial software quality by identifying and resolving bugs and other issues that can impact functionality and performance.

- Better decision-making: Error tracking provides businesses with real-time insights into the performance of their financial website or software. This information can be used to make informed decisions about product development, customer support, and other critical areas.

- Cost savings: By identifying and resolving errors quickly, error tracking can help businesses save money by reducing the costs associated with downtime, lost data, and customer support.

Try ReplayBird for free now

Free 14-day trial. No credit card required. Easy setup.

- Home

- Industries

- Financial Services